- #Review xero accounting software install#

- #Review xero accounting software software#

- #Review xero accounting software professional#

#Review xero accounting software software#

It’s a matter of personal choice to a business owner if this is considered a cost worth swallowing – though it should be noted that the additional funds directed toward payroll also accommodate a range of HR software needs. Overall, an SME with a Premium accountancy package looking to run payroll for 12 employees will pay £49 to Xero each month (potentially more, depending on additional accounting needs.) This is charged at £5 per month for your first 5 employees, then an additional £1 per hour head for each employee on your payroll. Naturally, though, you’ll need to pay a little more for payroll services.

#Review xero accounting software professional#

That sounds like a lot, but you’d need to pay a lot more for a professional accountant! As an SME, you’ll likely need the Premium service, charged at £33 PCM. Xero is billed for its accountancy services over three tiers. Again, this could cause a problem for users that lack comfort and familiarity with technology. Queries and issues will invariably be managed online, presumably due to the time difference between hemispheres. On a similar note, it should also be noted that Xero has minimal customer support over the telephone.

#Review xero accounting software install#

All it takes is one employee refusing to install a company-centric app on their personal appliance to bring down the whole idea. In that case, confusion can quickly reign. Suppose your team are not comfortable with such machinations, though. A line manager can also approve this holiday request with equally little fuss. That could be in the office or at home on impulse following a conversation with their spouse.

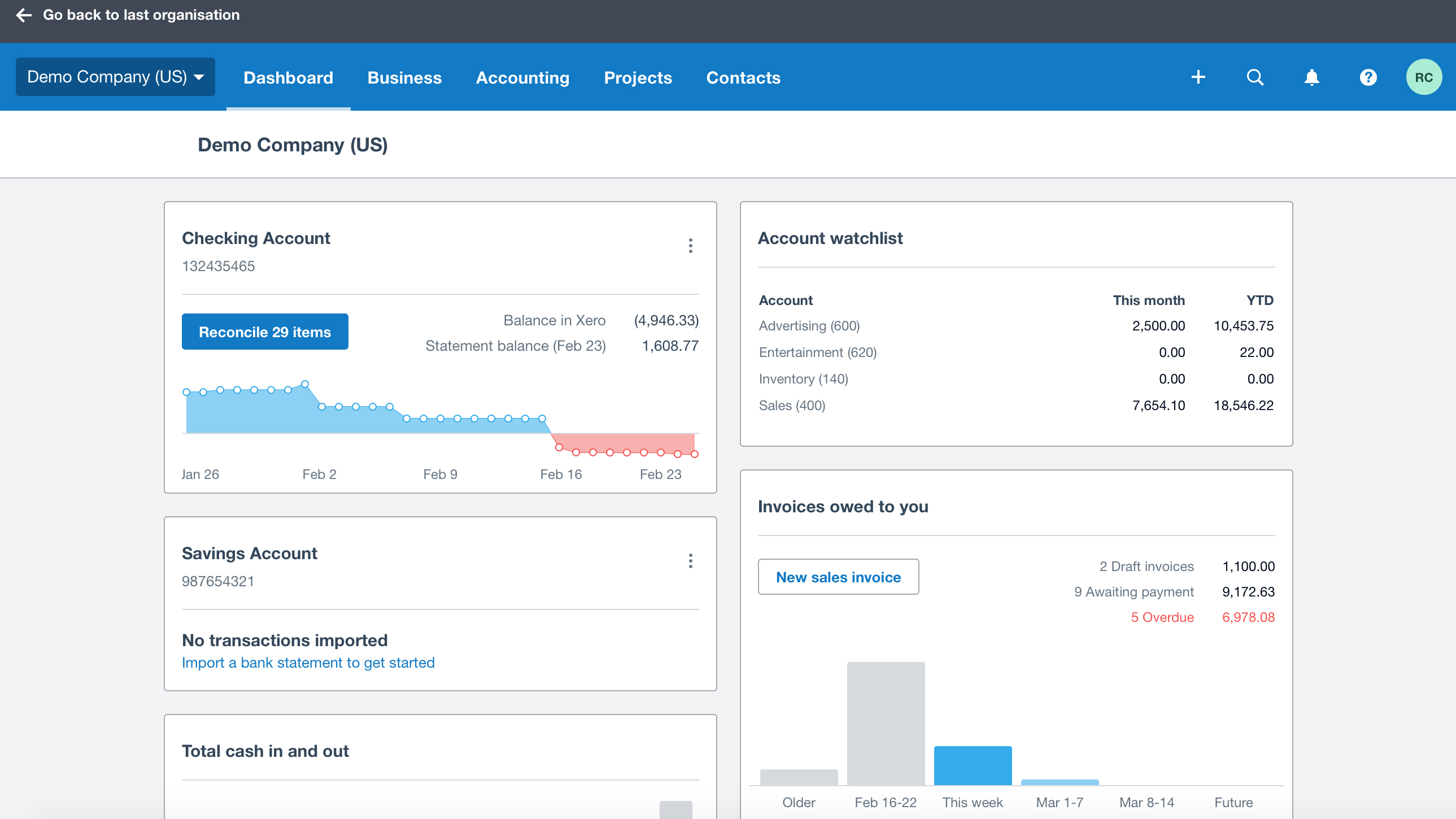

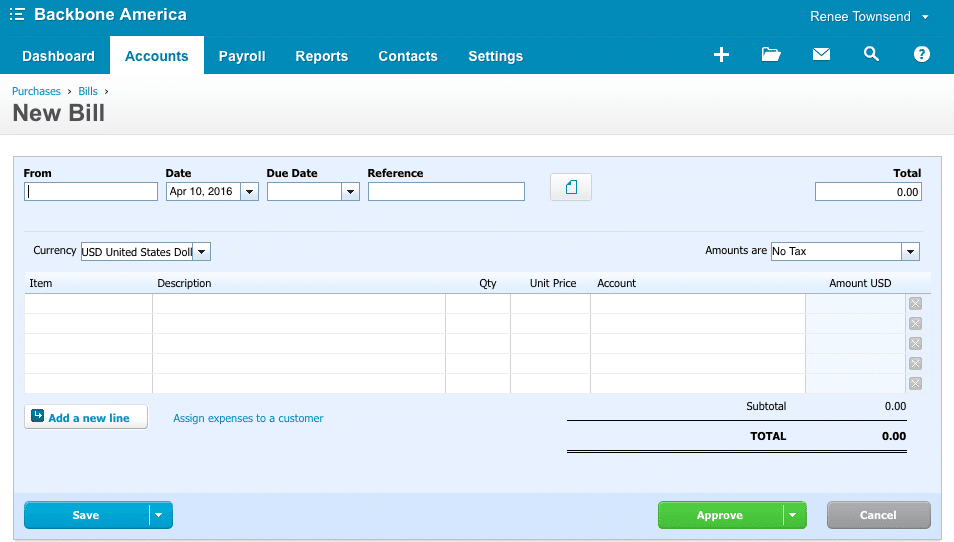

One team member could request a holiday at the touch of a button, at any time, from the Xero app on their personal smartphone. One of the significant advantages of the HR features found within Xero is the ability to use the app. Other than businesses that are only looking for help with payroll, Xero should only really be used by companies with a tech-savvy employee base. Most of what this software offers, and lest we forget charges you for, will be considered redundant. If you’re looking for purely payroll software, having your accountancy needs under control thanks to an employee or other software package, there is little point in investing in Xero. As payroll is considered an add-on service, you’ll enjoy plenty of flexibility on how much you end up spending. The price points begin at under five employees and rise from there. In addition, there are no upper or lower limits on how many people need to be included on payroll with Xero. Xero promises to simplify everyday tasks for an SME, and when it comes to keeping a lid on bookkeeping, it does precisely that. In this regard, the payroll element of Xero should be considered a bonus, not necessarily a selling point. Essentially, you’ll be bringing in the services of a dedicated accountant – without the need to hire a payroll manager and all that entails. What’s more, you can use Xero to pay any outgoing bills, manage expenses and all other manner of tasks. If you sign up for a Xero package, you’ll have access to all manner of projections and reports that surround your business spending and profit and loss. Xero is the perfect solution for a small business that seeks help balancing their accounting and payroll needs in one package.

0 kommentar(er)

0 kommentar(er)